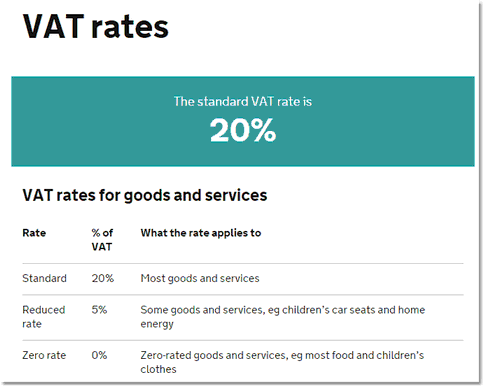

The VAT code is setup in the cloud and then transmitted to the terminal. It is used on both the Cloud reporting and on the Point of sale terminal to calculate the VAT amount as well as profit calculations. Below is a sample of rates from www.gov.uk On the POs terminal it can be used to show the Vatable amount as well as the VAT content on the reciept and reports.

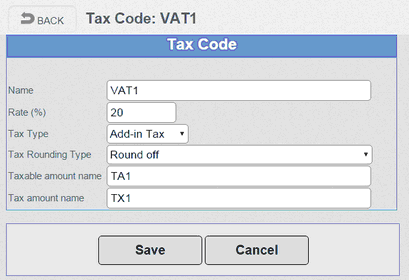

To configure a VAT rate type a description that describes the VAT rate Name such as Standard or Reduced rate then enter the percentage Rate such as 20 for 20%. There are several options for the Tax type The Add in Tax option is used for the majority of business in the UK as it will extract the VAT amount from the retail price. The Tax rounding is usually left at Round off This means it will round ether up to the nearest penny or down according to the fraction left after the vat calculation. Taxable amount name describes the amount of the transaction without the VAT and the TAX amount Name describes the VAT content of the transaction.

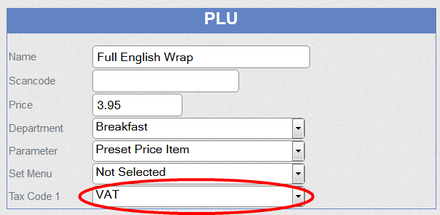

Once the VAT rate has been configured the rate can be set in the PLU and ingredients screen. when a change of VAT rate occurs only the rate needs to be changed not all the indvidual products.